Economic volatility and inflation: what does it mean for your business?

For your fleetWe have started 2024 the same way we ended 2023 – with uncertainty lingering. It’s an ideal moment to take the temperature of the Australian economic climate.

It’s also worth considering how expert forecasts suggest businesses should continue to tread carefully in light of ongoing economic instability.

Let’s dig into the numbers.

THE BIG PICTURE – A general overview

As the worst of the COVID-19 pandemic fades in the rear-view mirror, many economies around the world have been dealing with rampant inflation.

Australia is no different.

The Reserve Bank of Australia (RBA) has instituted a series of interest rate rises with the aim of dampening demand, and ultimately bringing inflation back under control. Alongside this, cost-of-living pressures are putting Australian businesses and families under considerable pressure.

As we detail below, ABS data illustrates that GDP is improving — although well below its pre-pandemic benchmarks — and, with inflation on a downward trend, the outlook for the Australian economy still has a note of caution attached to it.

Effects of interest rate rises are showing signs of impacting the job market through rising underemployment, leading to calls for rate cuts as soon as the RBA Board meets in March 2024.

Following are the details.

Gross Domestic Product (GDP)

Noting that the 2023 December quarter results (and, by extension, the annual GDP figures) aren’t available at the time of writing, the most recent available data shows the Australian economy grew by 0.2 percent in the three months from 30 June to 30 September in 2023, an overall jump of 2.1 percent compared to the same time in 2022.

Despite the rise, GDP growth remains well below the three percent annual figure of the pre-pandemic years. The National Accounts summary shows growth was due to “increased government consumption, and capital investment during the quarter. Growth in both household consumption and GDP over 2023 had slowed due to sustained cost-of-living pressures and higher interest rates.”

Inflation

Inflation continues to be one of the most significant factors in our economy.

In what’s been universally recognised as good news, the most recent quarterly CPI figures showed a fall in inflation from 5.4 percent in the September quarter of 2023 to 4.1 percent in the December quarter.

“That fall is the biggest drop – outside the 2020 lockdowns – for more than a decade,” wrote Economist Greg Jericho. “It means inflation is going down almost as fast as it went up.”

Employment and wages

ABS data for January 2024 shows unemployment currently sitting at 4.1 percent, a rise of 0.1 percentage points from December 2023. Sentiment from many economists suggests it’s a sign that the economy is slowing.

Of further concern, economist Stephen Koukoulos references the rise in underemployment across the economy:

“We’ve had an incredible 5.7 percent fall in hours worked,’ said Koukoulos. “The skewing [of the labour market] away from full-time to part-time continues, and even those working part-time are working fewer hours than they want to, hence the underemployment rate has shot up to 6.6 percent.”

He goes on to argue that an interest rate cut from the RBA is imperative to avoid further rises in unemployment: “We’ve got a real problem occurring in the labour market. As we know, the labour market doesn’t turn around quickly, so… the RBA does need to cut rates. If it wants to stop the unemployment rate hitting five percent, it can’t sit there and leave the cash rate at 4.35 percent.”

Interest rates

Interest rates have enormously influenced the Australian economy, particularly as inflation has risen in the post-pandemic period.

At the time of writing, the RBA’s official cash rate was 4.35 percent. At its February 2024 meeting, the RBA’s Board decided to leave this rate unchanged. In their meeting minutes, the Board noted the “decision supports the progress of inflation to the midpoint of the 2–3 [percent] target range within a reasonable timeframe and continued moderate growth in employment.

Economists from the four major banks appear to agree that interest rates have peaked at 4.35 percent. Analysts at both CBA and Westpac told Rate City there was a possibility of rates falling to 2.85 percent. CBA believes this could happen by June 2025, while Westpac predicts it as possible by December that same year.

Analysts at the NAB were slightly more conservative in their estimates, saying a fall to 3.1% by November 2025 was a possibility, and the ANZ was the most sceptical of the four, predicting a cash rate of 3.6 percent by June 2025.

FUEL PRICES AND INFLATION

As mentioned, while there are many positives for the Australian economy, driving down inflation and reducing cost-of-living pressures on households remains the focus of the Reserve Bank and the Federal Government.

But the impacts of reducing inflation aren’t just important to households. Many businesses —particularly those managing fleets of vehicles — have felt the pain of high fuel prices.

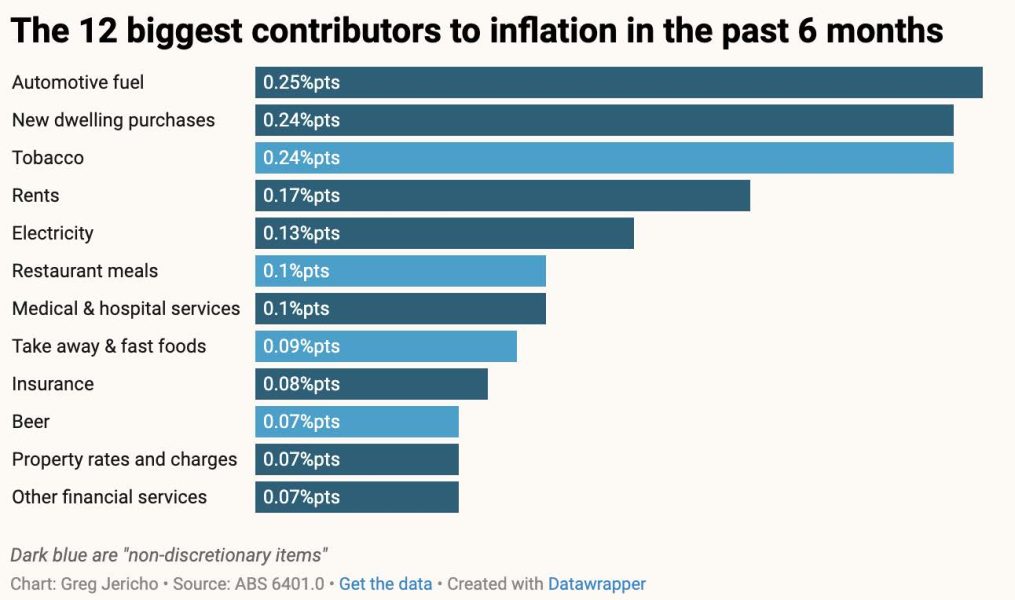

Writing for The Guardian, economist Greg Jericho highlighted ABS data that showed automotive fuel was the biggest contributor to inflation in Australia in the six months to December 2023. With Australia unable to directly influence the cost of a barrel of crude oil, we’re at the whim of international events and institutions, such as the OPEC, when it comes to our fuel prices.

Russia’s invasion of Ukraine in February 2022 prompted the European Union and other trading blocs to place sanctions on Russian oil exports. As the world’s third biggest supplier of crude oil (behind Saudi Arabia and the US), these sanctions led to a major reduction in the amount of oil available on global markets.

Here in Australia, the result of these sanctions has a major impact.

In the December quarter of 2021 (the last financial quarter before the conflict in the Ukraine), the average cost of 91 octane unleaded fuel in Australia was 164.21 cents per litre (cpl). In the March 2022 quarter (the first reporting period after the Ukraine invasion, with the subsequent embargoes on oil exports beginning to take effect) the average pump price of unleaded fuel rose to 183.32 cpl. In the December 2022 quarter, it reached 196.74 cpl — the highest average price since sanctions on Russian oil exports were imposed.

With no end to the conflict in the region in sight, not to mention escalating tensions in the Middle East, it’s likely that fuel costs to businesses and households won’t be dropping too far any time soon.

As well as existing environmental concerns, the inflationary impacts of fuel prices might mean it’s time for organisations that operate vehicle fleets to consider alternative energy sources. While automotive fuel heads the list of the 12 biggest contributors to inflation over the past six months (0.25 percent), electricity ranks fifth on the same list (0.13 percent), well behind the inflationary impact of petrol.

For some businesses managing fleets, this might be an opportunity to reduce costs over the long term, as well as improve your bottom line.

IN CONCLUSION

A look at the key indicators of the Australian economy suggests the risk of a sustained downturn, which means we’re not out of the woods yet. Just as household outgoings need to be closely monitored, businesses will be watching expenditures until there are calmer seas on the economic horizon.

While benchmarks like GDP growth and inflation are moving in the right direction, the latest unemployment data points to some major challenges for Australian households and businesses across 2024.

Start a conversation with SG Fleet today about the right strategies to deploy to keep your business moving through economic uncertainty.

Driving Insights

Driving Insights